What a reversal!

Everything had a red Thursday except for oil. Oil traders took the bait of Trump cancelling Chevrons’s tiny deal with Venezuela. Venezuela has some of the largest reserves in the Western Hemisphere and they can only produce 1/10th the output of Canada. That pumped WTI 2%.

I tried my best to catch some fools slipping with some at the money spreads expiring next week but couldn’t get any bites. This tells me that this is a weak rally and probably won’t last long.

I’m almost 100% certain we will see a substantial reversal in oil as the reality of the global economic downturn hits the oil traders like a tungsten pipe upside the head.

For the Nvidia and Palantir bros it was an attempted murder-suicide. It seems like nothing can help NVDA get out of the funk right now, not even super happy earnings. I think the PLTR pumpers will claim the stock is on sale and buy back in and probably get REMT more. $45-$50 is my mid term target for the stock.

The actual bright spot were the industrials. They are hanging on for now and the small caps didn’t take that bad a beating. I am short all the indexes am expecting a big pay day once the markets wake up and smell the burning GPUs.

The precious metals took a beating but not as bad as tech—this is typical, for when the margin call man cometh he taketh the gold first. Gold dipped below $2,900 after fighting the paper howitzers at $2,940 for weeks. The miners sucked donkey balls as usual. One day the miners are going to fly, but between now and then it’s going to be a terrible ride.

I don’t know if this is the start of the pullback trend or not, but I do know the timing is right to expect a downturn in the markets. My game is to continue to build buying power by running option campaigns, waiting around to ambush the indexes at their lows, then building back on a cheaper cost basis.

The talking buttheads are going to blame Trump and tariffs, and Trump again, but the reality is that this global recession started more than a year ago, and now that all the fog of excuses is blowing over the tide looks to be going out. There will be a lot of naked swimmers blaming everything for their cock and ball shrinkage.

For my long term hold Amazon, I’d like to see a pullback all the way to the $150 handle or so before buying a lot more. That’s a long way down from here but who knows how long and deep the recession will go.

Friday looks like it’s shaping to to be a whoopin ass day. The VIX has shot up and everyone running for cover. I’m expecting USO option money to flow into my pockets, but at the same time hunting for new entries might be tough.

If you’re up a lot in anything it may be a good time to take some profits off the table as March and the bottleneck approaches. There is a lot of air under the markets and we will likely lose more altitude while the recession gets sorted out.

Good luck

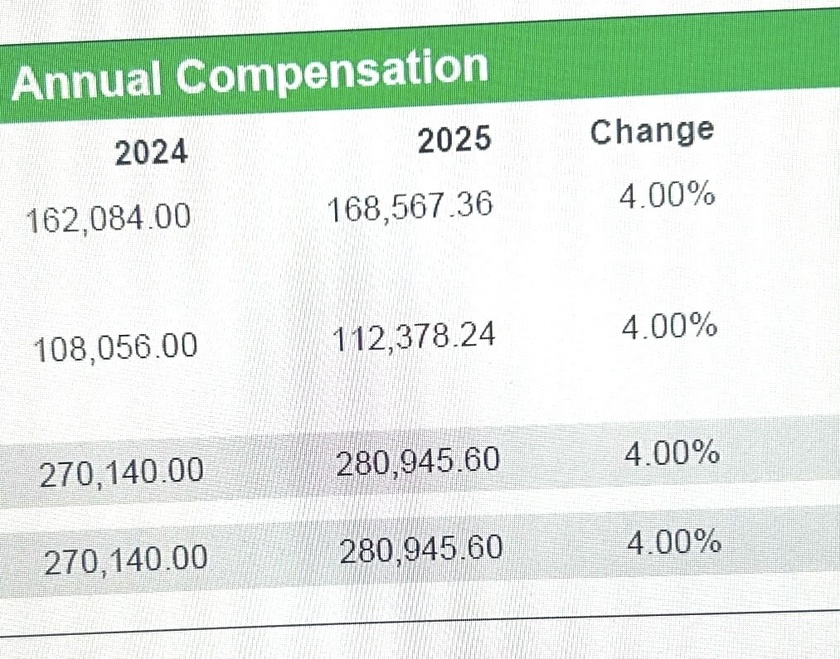

This is why I write my weekly reports and don't complain about my corporate enslaver.

It's only a 4% raise, but it compounds the more you make. I started at $250K in 2022.

I'm a sales engineer and the $168K is just my base salary, the rest is my comissions comp if I hit 100% quota. I've consistently hit and exceeded my sales quota.

They also mailed me an Xbox as a award for last year's performance

Boss up ninjas

@CoachGregAdams Boss Up 2025… All I know about content creation is what I’ve learned from all your MM replays. I’m already a winner and I’ll continue to win. Thanks for pushing me to try shit and level up. I’m richer than I’ve ever been in large part because of what you’ve taught me. I’ve learned more from you than anyone else in my life. Much love (No Diddy) 🙏Respect to you sir 🫡

You are the true Master NegRoshi.