Don’t be fooled by this Deepseek bullshit. That’s just a shiny object.

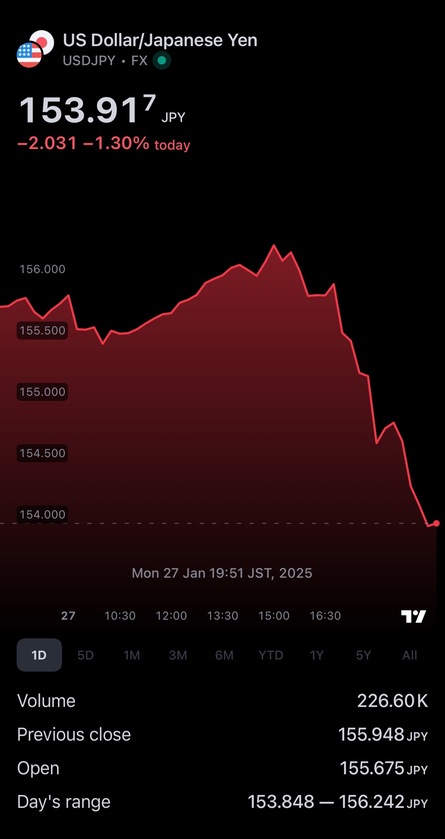

The real reason for the market pullback is the hot money borrowed in Japan, having to return home.

Once again the Yen carry trade causes chaos. The carry trade bros are HIGHLY levered so even 25 bps hike is like Mt Everest. Their borrowing costs just doubled. So they need to get the money out of the U.S., converted back to Yen and pay off the loans and lines.

All this hot money was in the Mag 7 and it’s going to get crushed today as the money comes out.

I’m not going to be surprised if gold and silver get hit too. That’s usually what happens when the margin call man comes knocking. However there is a possibility that commodities do relatively well. Including oil.

I love days like this because I’m always prepared for days like this. The days when the tide goes out and all the naked people are embarrassed.

But have no fear. In a couple of months or three the markets may be back at all time highs.

Good luck

Wishing you a strong and meaningful Christmas season. I’m sincerely grateful for your loyalty, trust, and unwavering support—it does not go unnoticed. May this time bring well-earned rest, renewed focus, and the drive to take on the year ahead with confidence and purpose. Thank you for standing with me. Merry Christmas Coach Gang!

Yo @CoachGregAdams !! Cooooaaach!! This is it!! We need this!!

*Sadly, I didn't do this one, but it GO HARD!! https://www.instagram.com/reel/DUbFXKIkTh7/?igsh=bjlka2lhdWtiMjVu

How the CGA vs JS debate would go... JS is the trashcan.

Joey, even Matt Walsh knows better than to open that can of whoop ass and have to eat it. Do you really want to start some shit you can't get yourself out of? Hafeez doesn't even have a career left and AW's is falling apart as we speak. Do you truly believe you stand a chance 😂?